Macro Trade ideas for May

Good Morning!

It looks like western countries are positioning themselves to reopen. Having shut down their economies in late q1 and into early q2, we are likely to see economic activity coming back over the next few weeks. As this continues, we expect things to return to some sort of normalcy as we slowly navigate out of this economic crisis.

The economic shocks will be with us for the foreseeable future. It is pretty evident as things stand that going forward, any macro data released will be lagging; we all expect higher unemployment numbers as the data from continuing unemployment claims continue to trickle through. This data set tends to lead unemployment as it highlights the total number of people who are furloughed but continue to seek unemployment benefits. After their initial claims go through should they remain on the system for the following week, they become classed as unemployed. This figure currently stands at 18 million. I also expect to see some underperformance from emerging markets, China, and Australia. I expect a bounce-back; however, I am skeptical that it will persist sustainably. I expect inflation to remain low, and this depressed inflation should continue well into the fourth quarter (more on this later). We see a ''bounce” currently priced in from the abysmally low levels of activity in March, however until the macro environment improves or consumer sentiment bounces (more on this later), I think the pain persists.

When assessing the current landscape, it is vital to have a few key economic drivers to hand as they provide a useful tool when navigating these uncertain waters. These drivers aid in developing a process and a framework for understanding how best to position ourselves in the months to come.

Now then. The major themes for the month will be to short the consumer, short exposures to China, be long consumption of staples, be long the dollar, short discretionary spending and long healthcare.

My underlying fundamental predisposition is bearish consumption and bullish staples. I will list a few names we will be watching over the month with potential entry and exit points shortly. But first, let's look at some abysmal data.

• Headline PPI: 0.7% ( down )

• Core PPI: unchanged at 1.4% (down)

• Headline CPI: 1.54% )down)

• Energy CPI: -5.74% (down bigly)

• Core CPI: -2.09% YoY

• Core Services CPI: 2.83% ( shat the bed)

• Core Goods CPI: -0.19% YoY

• University of Michigan NTM CPI Survey: -2.1%

• Headline University of Michigan Consumer Sentiment Index: to 71 ( down even biglier). That's just za USA.

China???

• Headline CPI: -about 4% weakening

• Food CPI: 18.3%

• Pork CPI: weak

• Nonfood CPI: -0.7% YoY (weak)

• Headline PPI: -1.5%

• OECD China Business Confidence Index: 96.11 (weak )

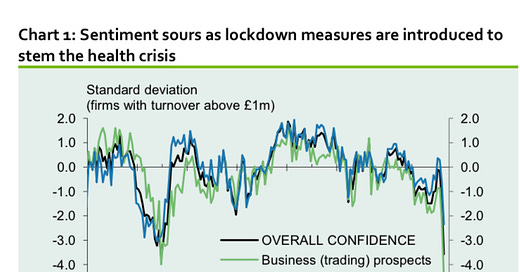

Let's not even go into Europe. You know what? Yeah, I will. Let’s see what the UK has to say, shall we?

It doesn't look optimistic. There is no bottom in sentiment yet.

Winners and Losers

This is an environment with a shit tonne of downside risk and minimal upside which brings me back to my fundamental predisposition; This month, I seek to short consumption and discretionary spending while exposing myself to consumer essentials. Let's get dirty and spit some ideas out.

Short Australia

We could see a bounce towards 5500. I would be a seller at that level. We could also see a break of 5100 would likely lead to collapse to 4600. Be agile enough and prepare for both scenarios.

Short the GBP

A short here makes sense. GBP vol is down from the highs of March, but I expect the slow bleed in sterling to continue. As the US opens up in May, we may see some substantial outperformance in the dollar. We are selling around 1.25-1.26, with a target of 1.22.

Short Retail

(Hanes) This retailer has a potential immediate downside risk of $8.00 and a long term downside risk of $7.00 (note the decelerating growth in the return of capital and earnings).

Long XLP

The US consumer is currently filling for 800 billion USD in loan forbearance; I, therefore, do not expect the US consumer to purchase big-ticket items. They will, however, have to buy food, canned goods, and a whole lot of Pepsi and Doritos while they sit at home and collect those ‘‘ BIG BEAUTIFUL CHEQUES” form ''Stevo Municho''. The upside from here looks to be around $3.

Short industrials

ITW is exposed to the restaurant industry (they provide equipment to restaurants) if restaurants are going to take a hit due to social distancing and lack of consumer confidence, then the price should reflect this. We could get a rise in price around here to the 170 area. That is where I would be looking to get short. If it breaks the short term trend, I would also get short. This one might need some patience before execution.

Short Gambling

BYD is exposed to consumer spending earnings estimates that have collapsed a $19 upside risk vs. an $11 downside risk looks good from here. Macau ( WYNN Macau $16.42 ) is also an excellent short with an upside risk of $18 vs. a downside reward around $14.

30-second Elevator Pitch: Consumer spending will contract further than expected short discretion/ long staples. Ase the month progresses I have other industries to add to the short bias list too, for example, the advertisers.

Managing risk and sizing: One way I go about putting shorts or longs on is to allocate 2-3 percent of capital to my positions. A starter position of around 1% is the right place to execute the trade. As trades become successful, add 0.5% each time until maxed out. If it is not working, I decrease by 0.5%. Dispassionately.

Update on Current positions :

Short on the Dax @11000 initiated 30/april/2020 ( in profit)( 3.68%)

Long Kroger @ 30.88 initiated 09/april/2020 (in profit) ( 5%)

Long Euronav @9.22 initiated 09/april/2020 ( in profit), all unrealized. (7.03%)Short peloton @28.80 initiated 13/april/2020 (unrealized loss) ( still in the trade)(11%)

short CMG @848 realized loss( 1%)

Courage Asemota

Disclaimer:

The ideas shared here are not recommendations to buy or sell any asset. Losses from trading may be higher than the capital deposited. Trade at your own risk!